Matagorda County Property Tax Rate . matagorda appraisal district is responsible for appraising all real and business personal property within. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners.

from fullstringerrealty.com

How to present your case at appraisal review board hearing for homeowners. matagorda appraisal district is responsible for appraising all real and business personal property within. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda county commissioners will consider a lower property tax rate next week, but rising.

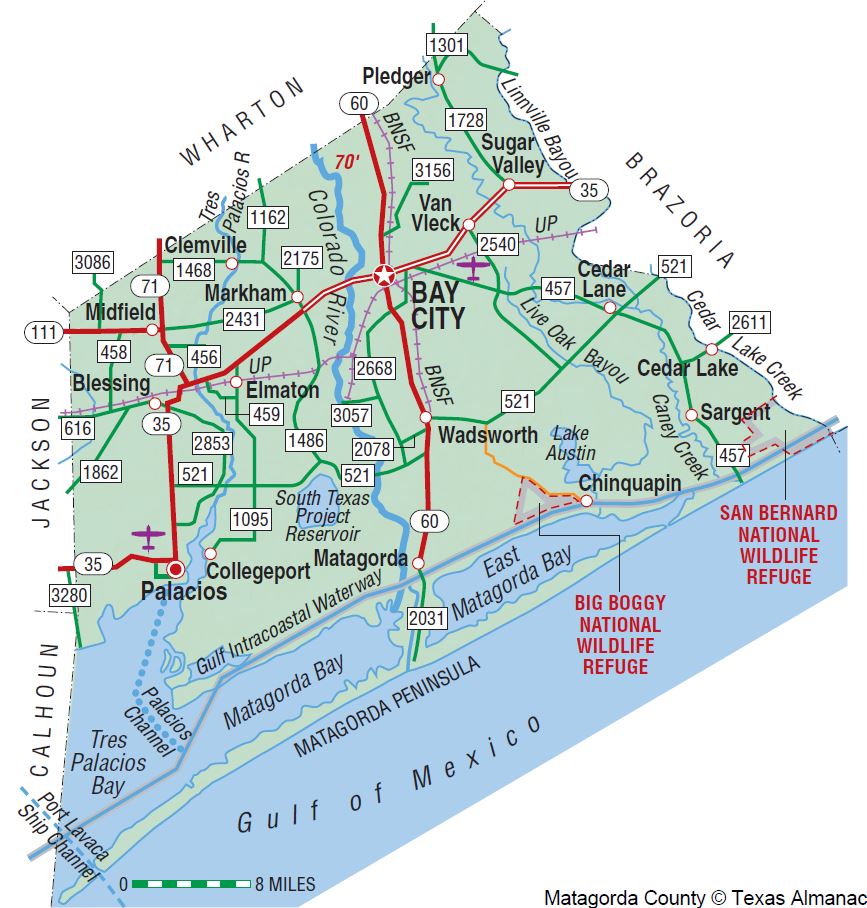

RB_matagordacountymap Full Stringer Realty Serving the Texas Gulf Coast

Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. matagorda appraisal district is responsible for appraising all real and business personal property within. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling.

From texasscorecard.com

North Texas Cities Top 20 Highest Property Tax Burdens Texas Scorecard Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per. Matagorda County Property Tax Rate.

From texascountygisdata.com

Matagorda County GIS Shapefile and Property Data Texas County GIS Data Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda appraisal district is responsible for appraising all real and business personal property within. matagorda county commissioners will consider a lower property tax rate next week, but rising. the median property tax (also known as real estate tax) in matagorda county. Matagorda County Property Tax Rate.

From maiabmarielle.pages.dev

Midlothian Property Tax Rate 2024 Amber Sapphire Matagorda County Property Tax Rate matagorda appraisal district is responsible for appraising all real and business personal property within. How to present your case at appraisal review board hearing for homeowners. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda county commissioners will consider a lower property tax rate. Matagorda County Property Tax Rate.

From discover.texasrealfood.com

Matagorda County TX Ag Exemption Maximizing Property Tax Savings for Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda appraisal district is responsible for appraising all real and business personal property within. tax rate calculation worksheets bay city independent. Matagorda County Property Tax Rate.

From www.tceq.texas.gov

matagorda county map Texas Commission on Environmental Quality www Matagorda County Property Tax Rate matagorda appraisal district is responsible for appraising all real and business personal property within. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. the. Matagorda County Property Tax Rate.

From fullstringerrealty.com

RB_matagordacountymap Full Stringer Realty Serving the Texas Gulf Coast Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. matagorda appraisal district is responsible for appraising all real and business personal property within. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. How to present your case at appraisal review board hearing for homeowners. the. Matagorda County Property Tax Rate.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Matagorda County Property Tax Rate the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda appraisal district is responsible for appraising all real and business personal property within. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review. Matagorda County Property Tax Rate.

From entdecke-pforzheim.de

laguhan at kabilaan halimbawa Matagorda County Property Tax Rate matagorda appraisal district is responsible for appraising all real and business personal property within. How to present your case at appraisal review board hearing for homeowners. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per. Matagorda County Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. How to present your case at appraisal review board hearing for homeowners. matagorda appraisal district is responsible for appraising all real and business personal property within. the. Matagorda County Property Tax Rate.

From sindeewjosy.pages.dev

Michigan Property Tax Increase 2024 Shea Shanon Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. matagorda appraisal district is responsible for appraising all real and business personal property within. How to present your case at appraisal review board hearing for homeowners. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per. Matagorda County Property Tax Rate.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Matagorda County Property Tax Rate the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. tax rate calculation worksheets bay city independent school district beach. Matagorda County Property Tax Rate.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. How to present your case at appraisal review board hearing for homeowners. matagorda county commissioners will consider a lower property tax rate next week, but rising. matagorda appraisal district is responsible for appraising all real and business personal property within. the. Matagorda County Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per. Matagorda County Property Tax Rate.

From discover.texasrealfood.com

Matagorda County TX Ag Exemption Maximizing Property Tax Savings for Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review board hearing for homeowners. matagorda appraisal district is responsible for appraising all real and business personal property within. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. the. Matagorda County Property Tax Rate.

From www.luxuryrealestatemaui.com

Maui Property Taxes Fiscal Year 2023 Tax Rates Matagorda County Property Tax Rate matagorda appraisal district is responsible for appraising all real and business personal property within. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda county commissioners will consider a lower property tax rate next week, but rising. How to present your case at appraisal review. Matagorda County Property Tax Rate.

From www.maphill.com

Political Simple Map of Matagorda County Matagorda County Property Tax Rate How to present your case at appraisal review board hearing for homeowners. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. matagorda appraisal district is responsible for appraising all real and business personal property within. tax rate calculation worksheets bay city independent school district beach. Matagorda County Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Matagorda County Property Tax Rate matagorda county commissioners will consider a lower property tax rate next week, but rising. matagorda appraisal district is responsible for appraising all real and business personal property within. How to present your case at appraisal review board hearing for homeowners. tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. the. Matagorda County Property Tax Rate.

From txcip.org

Texas Counties Total Taxable Value for County Property Tax Purposes Matagorda County Property Tax Rate tax rate calculation worksheets bay city independent school district beach road municipal utility district boling. the median property tax (also known as real estate tax) in matagorda county is $1,087.00 per year, based on a median. How to present your case at appraisal review board hearing for homeowners. matagorda appraisal district is responsible for appraising all real. Matagorda County Property Tax Rate.